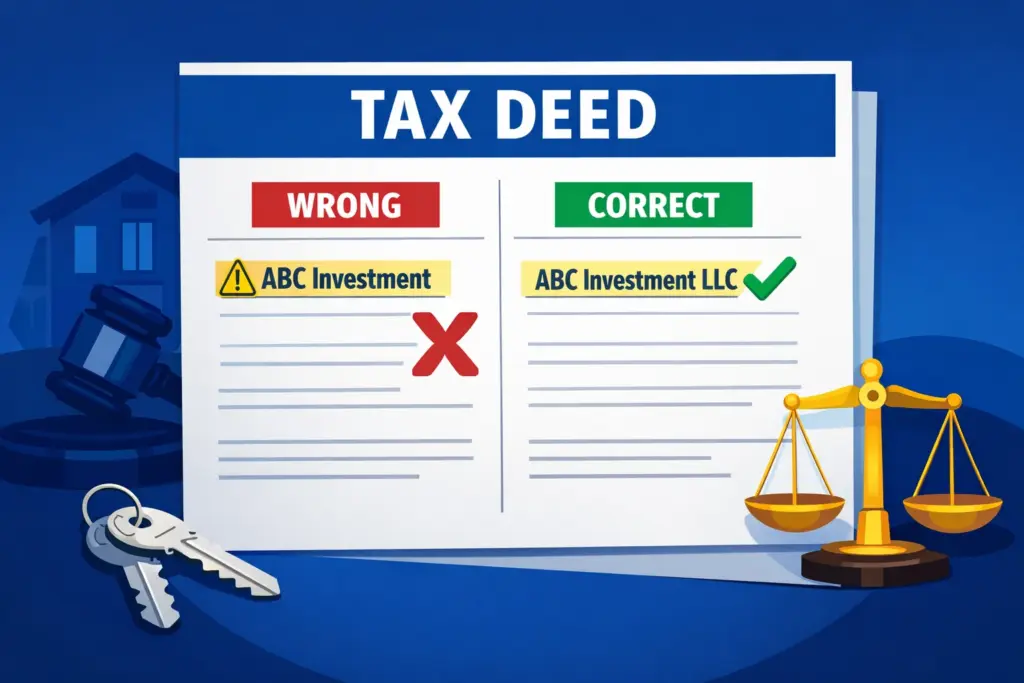

Ensuring your company name and the state of incorporation is properly reflected on the tax deed you purchase in Florida is a critical step that should never be overlooked. This seemingly minor detail can have significant legal and financial ramifications if done incorrectly.

Understanding why proper vesting of title matters (and what aspects create red flags for title policy underwriters later) can save investors from unnecessary complications, delays in transactions, and potential losses.

When you are registering to bid at the tax deed sale, what you put on the County form for the purchasing entity is exactly what will be reflected on the deed by the Clerk should you be the successful bidder, so it’s crucial forms are filled correctly.

What Is Vesting and Why Does It Matter?

The way ownership is “vested” effectively refers to how the legal owner of the property is listed on the tax deed. The name on the deed must accurately and fully reflect the correct information for the legal entity purchasing the property. If the company name is incorrect, shorthand, or missing essential designations like the entity type or state of incorporation, it can create issues that affect the tax deed purchaser’s ability to sell the property in the future.

Common Vesting Mistakes

- Omitting Legal Entity Designations – If your company is an LLC, corporation, or other legal entity, it must be listed with the proper suffix.

- Omitting the State of Incorporation or Using an Address that is not Registered for the Company – There may be entities with the same names registered in different states, so without including the state your entity is registered in, it could cause confusion over which entity purchased the tax deed.

- The address used on the tax deed should match the address for the entity as it is registered with the Division of Corporations in the relevant state.

- Incorrect addresses can happen when using “easy registration” websites that promise to lower tax implications of the LLC based on the state of incorporation. Often these websites register the entity using the preparer’s address, rather than the owner’s address which is then reflected on the tax deed. The mismatch of information has the potential to cause confusion about the proper purchasing party and causes a potential fraud red flag for the underwriters when you attempt to sell the property or obtain a loan.

- Make sure the entity owner’s address is reflected as the principal/primary address on registration with the state it is incorporated in and on deed.

- Shorthand, Misspellings, Variations or DBA/Fictitious Name Usage

- Even minor errors/discrepancies in company name can create headaches when trying to prove ownership or conduct future transactions, especially if the name incorrectly used is the name of another active entity. Fully spelling out correctly the name of the company is the only way to ensure there are no issues.

- A tax deed property cannot be solely vested in a fictitious name (or a DBA). The vesting name on the tax deed should include the legal entity registered with the state.

- Purchasing in the Name of Expired or Not Yet Registered Entity

- The entity used to purchase must be active and registered on the date you purchase

Consequences of Incorrect Vesting

Failing to vest your company name properly can lead to several costly and time-consuming problems, including:

- Title Issues– Incorrect vesting creates a potential title cloud, due to the confusion as to who the proper party in interest may be.

- Legal Challenges– Improper vesting may lead to legal challenges to your ownership/ confusion about who is the purchasing entity, potentially creating need for judicial orders to correct the problem.

- Resolving improper vesting once the tax deed is recorded is not as simple as obtaining a corrective deed. The vast majority of the time, County Clerks will not issue a Corrective Deed without clear evidence of their error.

- Resale Complications and Delays– If there are any vesting inconsistencies, underwriters may require extensive documentation or legal action to clear the title.

Correcting Improper Vesting

The available resolutions can require additional financial burdens and closing delays, and potentially the loss of buyers on a tight timeline.

- A substantial amount of internal documentation for underwriting approval may be required due to mismatched information, including but not limited to, receipts from tax deed sale, emails, operating agreements, bank statements / wire transfers, and registration information. This if often not enough to satisfy the potential fraud concern.

- A quit claim deed may be needed from another entity if wrong state of incorporation or a misspelling is listed on the tax deed.

- Ultimately, a reformation action (a legal procedure that modifies a deed) may have to be brought through the courts to correct any of these potential vesting mistakes. The tax deed owner would not be able to sell until this judicial case was concluded/an order entered, creating a potential delay of several months.

Also of note, a quiet title action alone will not correct a vesting issue on a tax deed! You will have to include a separate reformation count to specifically address the issue, adding to the cost.

How to Ensure Proper Vesting

Tax deed purchasers can avoid these issues from the start by paying close attention when filling out the tax deed bidding application/tax deed form you fill out upon purchase (depending on the county).

- Provide all the necessary information for the entity purchasing the tax deed

- Full registered name of the purchasing entity (No shorthand, misspelling, include registered name for DBA)

- Type of entity (LLC / INC / LLP/ etc.)

- State of incorporation of the entity

- Use the address registered with the Division of Corporations.

- Make sure your entity is active on the date of the tax deed sale.

With most tax deed bidding occurring online, bidders can easily correct any potential discrepancies before the tax deed sale. This is a crucial step that protects your investment and prevents legal complications. Taking the time to ensure accuracy can save investors from future headaches and ensure smooth transactions. Whether you’re a seasoned investor or new to tax deed sales, always double check how the title will be vested based on the information in your account just before bidding!