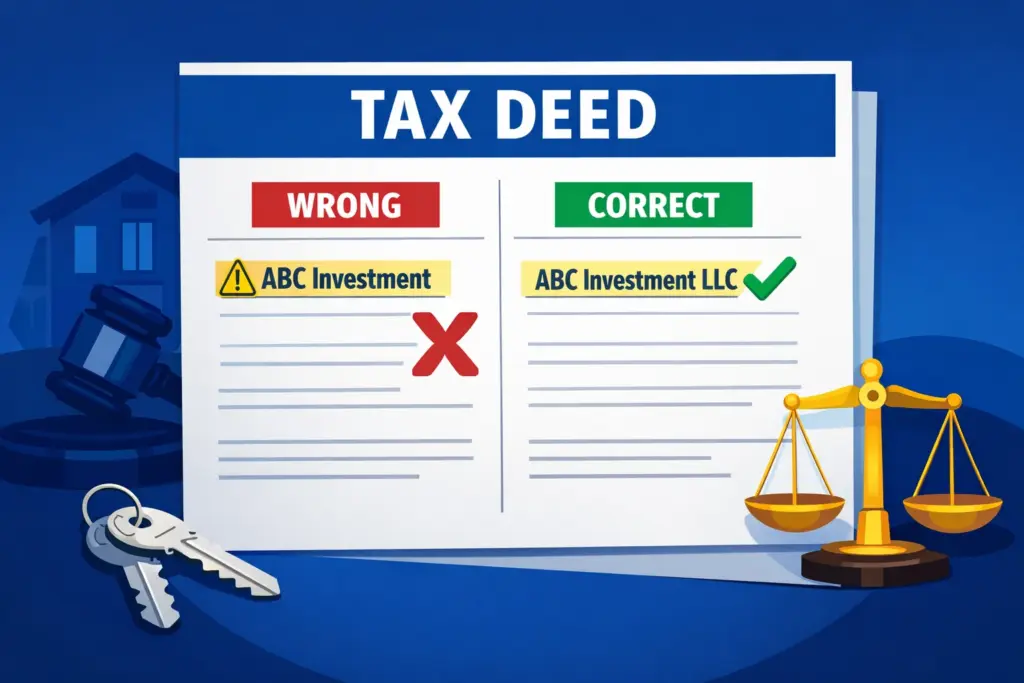

A Vested Interest: Tax Deed Properties and the Importance of Proper Vesting of Title

Ensuring your company name and the state of incorporation is properly reflected on the tax deed you purchase in Florida is a critical step that should never be overlooked. This seemingly minor detail can have significant legal and financial ramifications if done incorrectly. Understanding why proper vesting of title matters (and what aspects create red […]