2020 was a year of immense challenges and adaptation for many industries and businesses. The Florida real estate market, and the tax deed market within, were not immune to these difficulties and necessary changes in procedure.

In the tax deed market, the first bit of aftermath was felt in the auctions as county facilities closed to the public and their staff moved to home offices. Some tax deed auctions were not canceled but delayed. In some areas there were calls to allow for relief to homeowners that may have ordinarily redeemed their properties before auction and could not do so due to new unforeseen costs and concerns. Duval County actually had a lawsuit filed that prevented their tax deed sales from resuming until October.

In 11 of the top tax deed counties in Florida, we analyzed auction data to observe a snapshot of trends during the pandemic’s most pertinent months, as auctions were consistently running throughout the state in November and December.

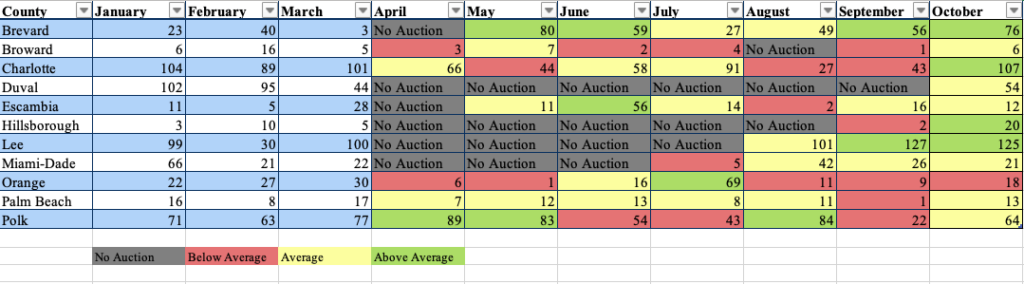

Besides the cancelations, there were not widespread reductions in number of tax deeds sold. 43% stayed relatively consistent with average numbers while the rest were varied between being lower (34%) and higher (23%) than average. Some auctions may have had larger amounts of properties than normal due to a backlog of filed tax deed applications and the county’s dire need for funds.

The majority of tax deed auction interruptions were due to closures of clerk’s offices and the interruption of in-person auctions. Several counties changed their auctions to an online format moving forward including Gulf, Marion, Alachua and St. John’s. As the staff in clerk’s offices transitioned to home work, recording delays and lack of continuity affected certain counties’ ability to hold auctions even online. Once staff began to trickle back into the office or adjust to their new home offices, the auctions began to resume.

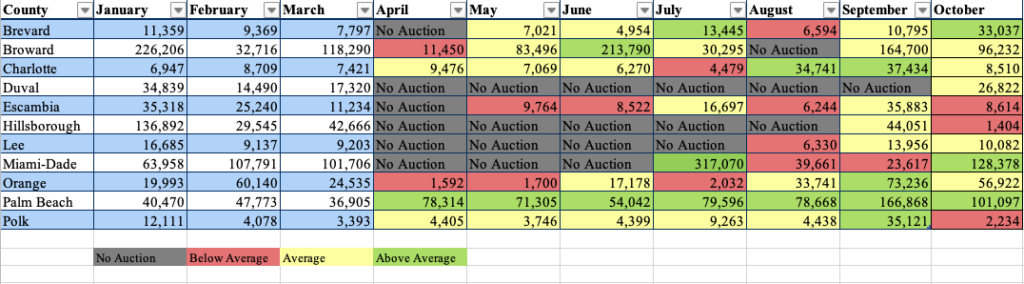

The value of the properties going to auction also did not see a drastic change across the board. 45% remained near average levels, with the remainder split between higher and lower averages.

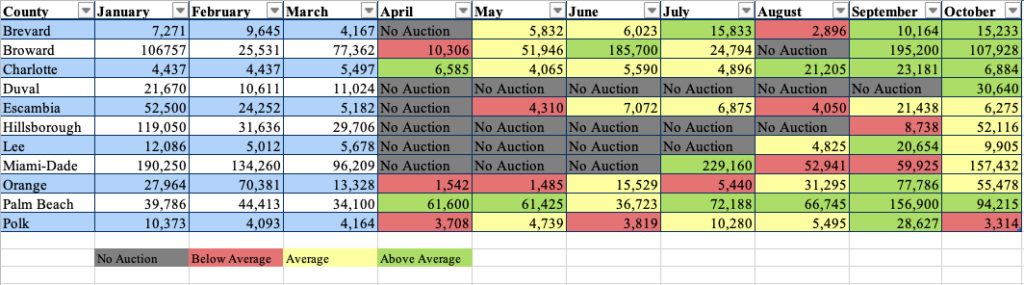

The average winning bid amount was also not at a uniform decrease. 39% remained average while 38% were higher than normal and only 23% were below the typical starting bid amount. Note: opening bid averages were nearly all average or above average, with only 4% being lower.

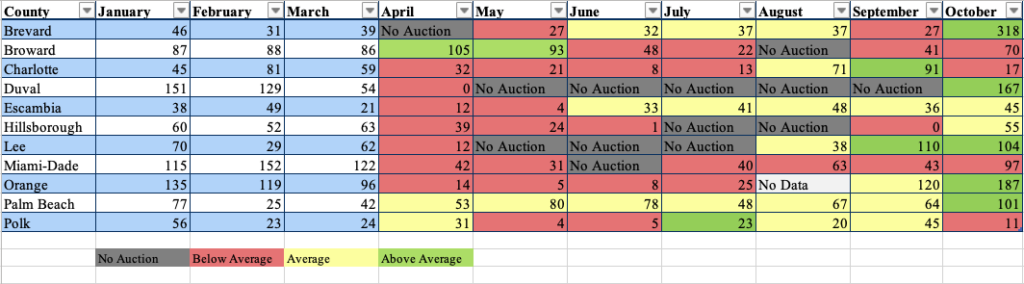

One noticeable impact was in redemptions, which are pre-auction tax/fee payments made by the owner to stop the sale of the property. While a third of the data was consistent with the average amount, 51% had lower numbers of redemptions and only 16% were higher. This seems to point at the fact that some individuals that may have ordinarily come up with the money to redeem their property may not have been able to due to financial impacts of COVID-19 (properties must be property tax-delinquent for over 2 years to be present on a tax deed auction).

Other Market Impacts

The real estate market as a whole felt the effects in March as lending became difficult with the discontinuation of several low down payment mortgage products and delays with appraisals and closings as in-person contact became restricted and in many cases prohibited. These challenges did affect tax deed sellers that had higher value properties, especially those with homes or other structures for which buyers required mortgages, as well as those attempting to refinance, as many refinance options became limited or were discontinued.

Resales became challenging with the inability for many Realtors to show properties to clients in person or hold open house events. Higher value properties on the tax deed resale market would have felt this impact the most.

Court closures caused mass delays for investors seeking evictions and even writs for the properties they had recently won. Furthermore, tax deed investors that traditionally used quiet title actions were waiting even longer than normal to gain clear title for their properties (although certification services such as our own continued throughout the pandemic).

Property tax deadline extensions in some counties may cause future interruptions as tax lien certificate sales would have been affected in the months of April and May.

Lessons Learned and Changes Implemented

There were many lessons to take away as a result of COVID’s impact to real estate and tax deeds. Those involved in real estate have rediscovered the importance of virtual tools, walkthroughs, and quality photographs as in-person showings became more difficult. Lending also saw its fair share of challenges and leaders in that industry will have to determine ways to assist lower down payment buyers without interruption and make appraisals timely during times of strife. The title industry adapted brilliantly with curbside closings, mobile notaries and other means of continuing business amidst the chaos.

For tax deeds, the online auctions made it much easier for counties to continue holding sales despite their physical locations. As with many industries, the move to online platforms could continue to increase. Many tax deed investors that previously preferred quiet title may continue to seek alternatives with court delays continuing into 2021 for many counties. County clerks and their staff did a remarkable job of continuing service despite working from home or in very small numbers in their offices.

Despite all the negatives of 2020, many significant changes were made to real estate and its surrounding industries that may make things easier and safer for buyers, sellers and professionals alike if the solutions continue to be implemented in the future.

We have also learned that even amidst great difficulties, the tax deed market provides consistent opportunity for investors looking to build wealth and expand their portfolios.

Ensuring your company name and the state of incorporation is properly reflected on the tax deed you purchase in Florida is a critical step that . . .

Over the past 10 years, we have helped thousands of tax deed investors with their tax deed title cloud, helping them achieve fully insurable title . . .