Over the past 10 years, we have helped thousands of tax deed investors with their tax deed title cloud, helping them achieve fully insurable title for their property. We often hear stories about the sorts of liens and encumbrances our clients run into during their research phase. On rare occasion, they find out after they purchased the property, which can be problematic, especially if they already have a closing scheduled or other plans for the property.

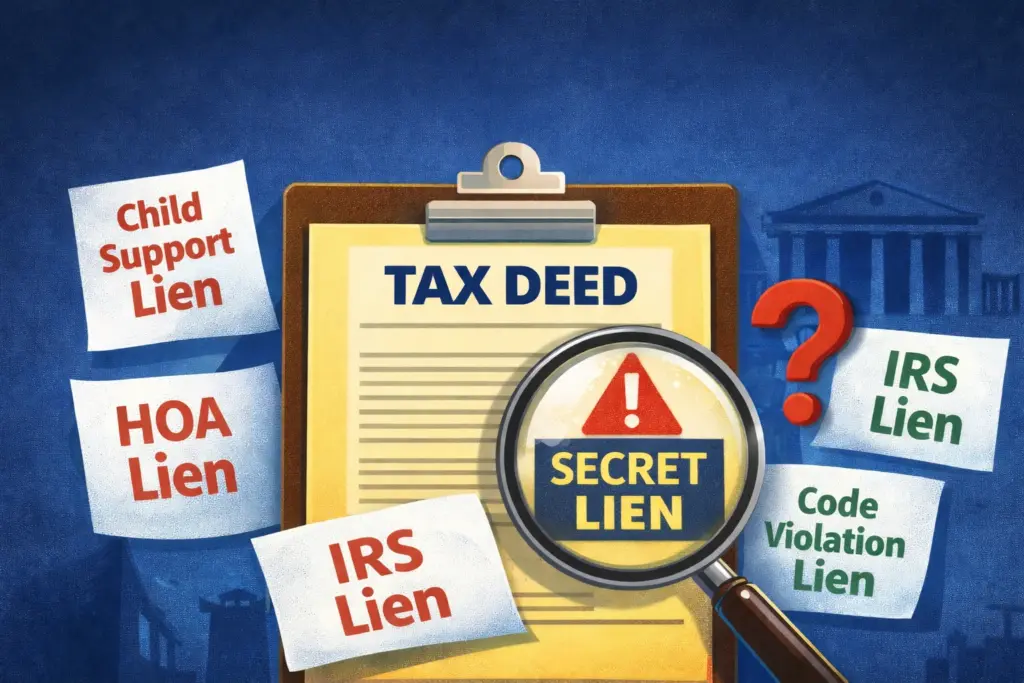

Investing in tax deed and distressed properties in Florida can be an excellent way to acquire real estate at a lower cost. While many liens are extinguished with the tax deed sale (Fla. Stat. §197.552), it’s essential to be aware of potential encumbrances that do survive. If you see them during your due diligence research, be aware they may prevent you from using or building on the property. And if you’ve already closed, try to take action as quickly as you can to help mitigate the situation and prevent a potential transaction from falling through or the tying up of additional capital in the property.

Agricultural Land Preservation Liens or Restrictions

In certain cases, Florida may place liens or restrictions on agricultural properties to preserve farmland or open space. They usually limit the property’s use for purposes other than agriculture and can be quite rare but impactful when they occur. Here’s a structured approach for an investor facing such a situation:

- Understand the lien/impact – Research its legal basis, duration, land use restrictions, zoning implications, and obligations for the landowner. Familiarize yourself with Florida’s regulatory framework governing such liens. Evaluate how the lien impacts property value, income potential from agriculture, and development limitations. Ensure these align with your investment strategy.

- Discuss – Reach out to the relevant department of the local governing body to ensure your understanding of the liens is correct. You may be able to negotiate the terms by presenting compelling reasons or alternative conservation measures.

- Seek legal advice – Consult with a specialized attorney to understand your options for compliance, negotiation, or challenging the encumbrance.

Historic Preservation Restrictions

If a property is designated as historically significant or falls within a historic district, the state or local authorities may place restrictions to ensure its preservation. These liens can limit renovations or changes to the property to maintain its historic character.

Before proceeding, it’s advisable to consult with the relevant historic preservation authorities. This could include local historic preservation boards, the Florida Division of Historical Resources, or the National Park Service for properties listed on the National Register of Historic Places. These entities can provide guidance on the process and feasibility of removing a preservation lien.

Fire District Liens

Properties located in certain fire districts may have liens or county resolutions imposed for the provision of fire services. These liens are relatively rare but can affect property use, especially if the property owner fails to pay for fire protection services. Fire District Liens often arise from unpaid charges for fire department services, such as extinguishing fires, conducting inspections, or providing emergency services.

If you believe the lien is unjustified or the amount is incorrect, you can dispute it. This process typically involves providing evidence to the fire district or appropriate local government authority to prove your case. Legal counsel can be beneficial in navigating this process, especially in complex situations. If paying the full amount immediately is not feasible, you may be able to negotiate a payment plan.

Environmental Liens or Restrictions

Environmental liens can be placed on a property if it has been involved in environmental violations, such as contamination, hazardous waste disposal, or other environmental hazards. These liens can prevent the property from being used or developed until the environmental issues are resolved.

Resolving an environmental lien typically involves cleaning up the contamination to meet regulatory standards and paying off any costs associated with the cleanup. Working directly with the Department of Environmental Protection regarding performance, investigation, and required remedial acts is essential to resolving the matter quickly and efficiently. Once the governmental entity is satisfied that the contamination has been adequately addressed and all associated costs have been paid, the lien can be released.

Public Works Liens

Large scale liens can be imposed by local authorities to cover the cost of specific public improvements or services, such as road paving, sidewalk installation, or sewer line extensions. Many times, these liens cover entire subdivisions or even cities, and they typically apply to a specific area or development project.

You may be able to negotiate the balance due, but usually these liens are imposed based on the hard cost of the public improvement. You are more likely to be able to work out a payment plan than a reduction in the amount. Some municipalities may offer exemptions or reductions under certain conditions. For example, properties used for specific purposes or owned by qualifying individuals (such as seniors or veterans) might be eligible for reduced assessments. Investigate local ordinances to see if any exemptions apply.

If for some reason you believe the assessment is unfair or incorrect, you can attempt to dispute it with the municipality directly. This process varies by county and by division. Documentation supporting your case, such as independent appraisals or evidence of errors in the assessment process, will be necessary.

Demolition Liens

Demolition liens, which can also be called special assessment liens depending on the county, are recorded against a property to cover the costs of demolition and debris removal carried out by a local government or municipality. These liens can be imposed when a property becomes a nuisance due to its dilapidated, unsafe, or abandoned condition, and the local government intervenes to demolish and clean up the property. Here are some key points to understand about demolition liens in Florida:

- The amount of the demolition lien is primarily based on the actual costs incurred by the local government for the demolition, cleanup, and related services. This can include the cost of labor, equipment, permits, and other expenses associated with the demolition.

- Priority of the Lien: Demolition liens are held by the county/ municipal governmental unit and they survive the tax deed sale. While the governmental unit will usually pursue any surplus funds, any remaining balance due will need to be addressed by the tax deed purchaser to obtain a release prior to any subsequent sale.

- Legal Consequences: Failure to address a demolition lien can have serious legal consequences. The property may be subject to foreclosure to satisfy the lien, which could result in the loss of the property for the owner.

When bidding on tax deeds, if a demolition lien exists on the property you’ve chosen, we suggest seeking legal advice and/or working directly with the local government to resolve the matter by paying it in full or potentially arranging a payment plan if available.

Code Enforcement Liens

Distressed properties often come with code enforcement violations which can be based on a wide variety of code ordinances, such as lot mowing, nuisance liens, unpermitted renovations, or maintenance issues. They may be referred to in the Official Records as code enforcement liens, special assessment liens, resolutions, or nuisance liens. The specifics for the process of their application and how to address them varies by county, municipality, and even by each division. Usually, local municipalities will impose these liens to cover the cost of bringing the property into compliance. Before purchasing a distressed property, it’s vital to conduct thorough due diligence to identify any outstanding code enforcement liens and assess the potential costs of rectifying the violations.

Similar to demolition liens, the local governing bodies usually do not negotiate down their actual cost. However, sometimes these liens will include fines or penalties as well. The best option for code enforcement liens is typically to negotiate down the outstanding balance of these fines or penalties by way of the special magistrate.

In the case of any of these liens, it’s crucial to monitor lien satisfaction. Once the lien is paid in full, ensure a release is recorded by the relevant government department in the Official Records confirming the lien’s satisfaction. This will be the impetus to clear the property title.

Investing in tax deed and distressed properties in Florida can be a rewarding endeavor, but it comes with potential challenges related to surviving encumbrances. To protect your investment, it’s essential to perform thorough due diligence, including title searches, and work with professionals experienced in these types of transactions. With the right strategy and guidance, you can navigate these challenges and unlock the full potential of your investment in Florida’s tax deed and distressed properties.

If you’re a tax deed investor and you need help dispelling the tax deed title cloud, Clear to Sell can help you do so for a fixed, flat rate under 30 days on average, with no restrictions on future sales or building, on a network of over 4000 FL title agents. Whether you’re a seasoned investor or just getting started, we have free resources for learning and for navigating challenges you may face in your investing journey.